Portfolio Family Offices Are Managing Too Many Fire Drills

“You buy a business, and the first problem? Who’s handling compliance? Who’s running payroll?”

It happens every time.

For portfolio family offices managing multiple operating businesses, this isn’t a rare challenge — it’s a recurring pattern. Despite the growth in complexity and asset size, many still approach each new acquisition as a standalone entity. That means fresh hiring cycles, new vendor agreements, and an ever-expanding tangle of systems and reporting lines.

At a certain point, this approach stops being manageable. It becomes inefficient, expensive, and a barrier to value creation.

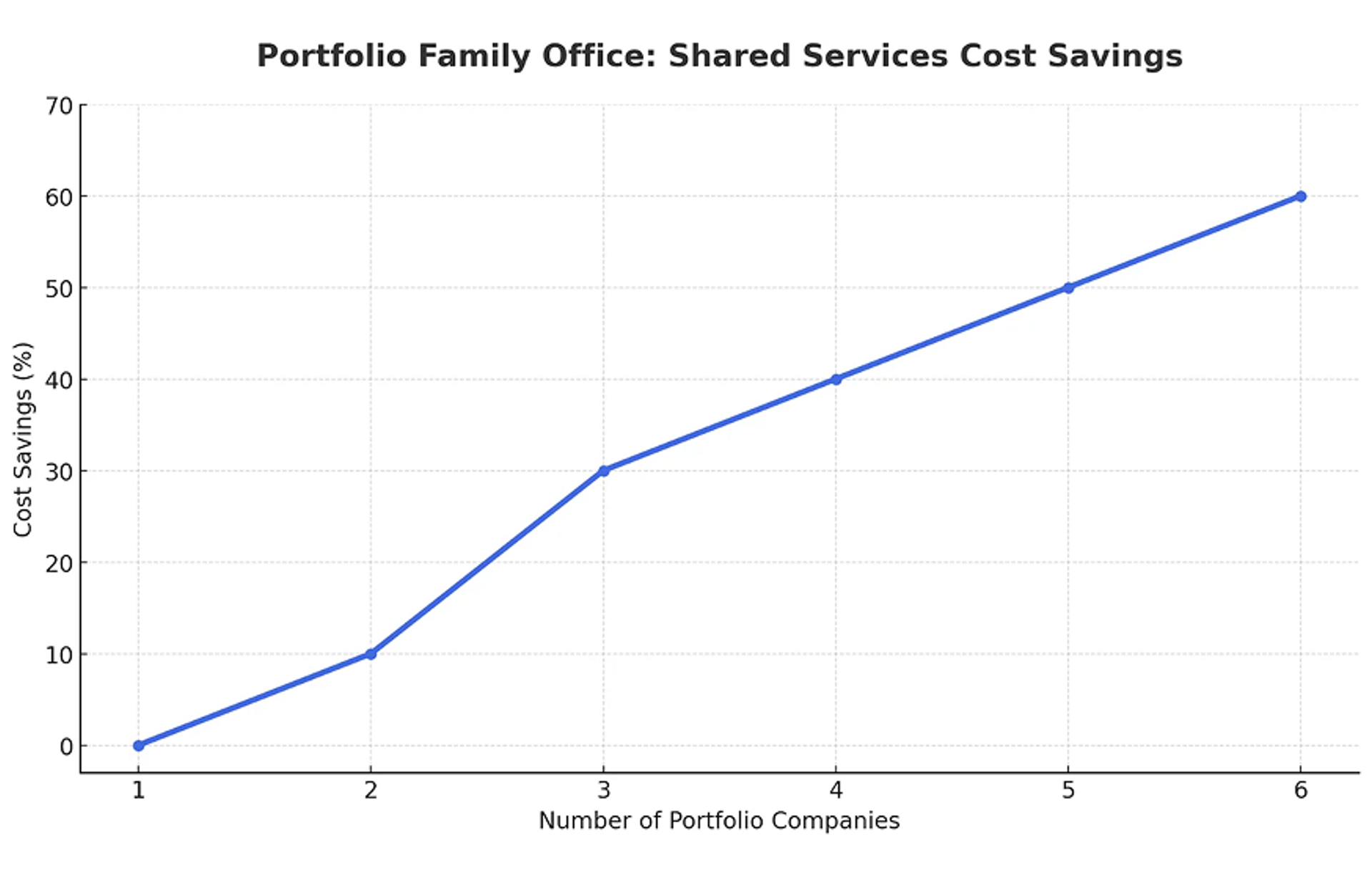

Family offices that act like investment platforms — with shared operational infrastructure — are the ones that move faster, integrate better, and unlock scale without unnecessary friction. Shared services aren’t an optional feature. They’re the backbone of modern, well-run portfolios.

What Shared Services Really Mean for Family Offices

Shared services aren’t just about outsourcing³.

They’re about centralizing repeatable, critical business functions — from Finance to IT to HR — and making them accessible across the portfolio. This model is already standard practice in large corporations and PE-backed PortCos, but many family offices are only beginning to see its strategic importance.

Key components include:

- Central finance and accounting

- HR frameworks for hiring, onboarding, exits

- Legal and compliance infrastructure

- Cybersecurity and IT systems

- AI-enabled internal reporting and analytics

Rather than reinventing the wheel every time a new business is added, these functions operate through a common framework. It’s not about losing control. It’s about building consistency without compromising strategy. Despite so many benefits, why do most family offices still don’t use shared services (and why is that risky now)?

Many family offices resist shared services for reasons that feel familiar, even understandable.

- Cultural habits run deep: “We’ve always done it company by company.”

- Autonomy concerns emerge: “Every business is different.”

- Complexity assumptions persist: “You can’t standardize HR for both a logistics company and a SaaS platform.”

- And then there’s short-term thinking: “We’re going to sell this business anyway — why bother with integration?

But these assumptions no longer hold up under scrutiny. Today’s portfolios operate in fast-moving markets. Running everything separately leads to duplicated costs, repeated vendor negotiations, hiring delays, and internal confusion each time you acquire or divest.

Even for companies slated for divestiture, clean, consistent operations improve valuation. Exit-readiness often depends not on the product or leadership team, but on whether the basic processes are investor-grade from day one.